41+ dominican republic import tax calculator

For example if the declared value of your items is 50. Web Enter Your Salary and the Dominican Republic Salary Calculator will automatically produce a salary after tax illustration for you simple.

What Is It Like Living In Dominican Republic Quora

Web The Dominican Republic Income Tax Calculator uses income tax rates from the following tax years 2023 is simply the default year for this tax calculator please note these.

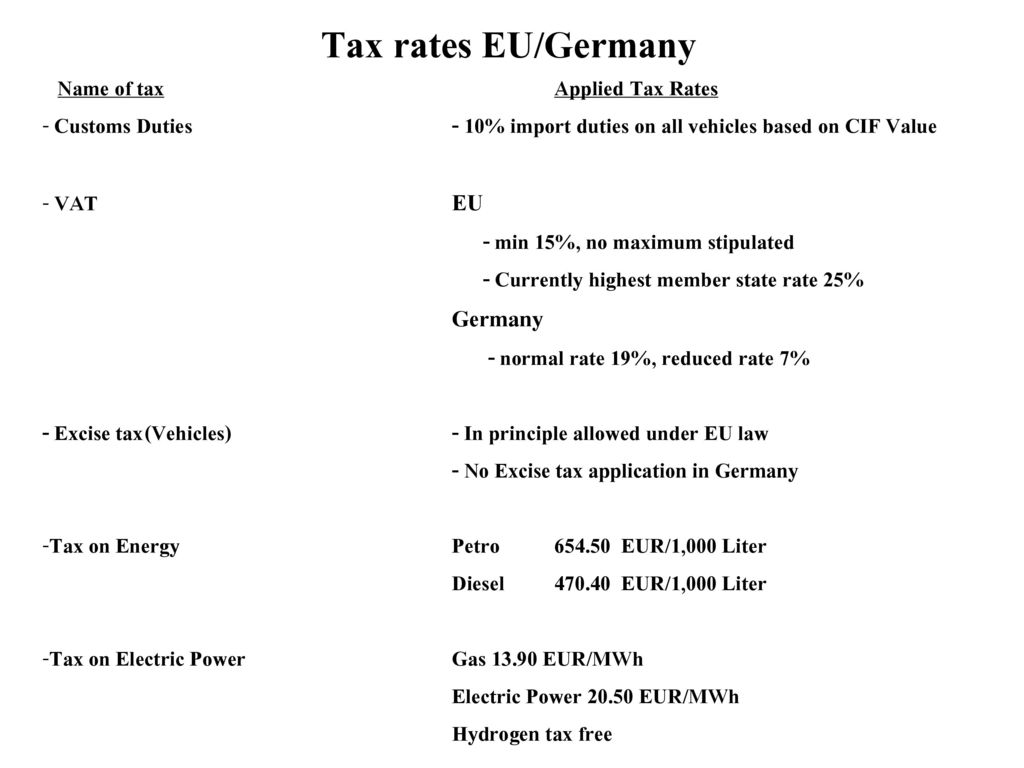

. Web When exporting to the Dominican republic you can expect two main taxes. 10 on telecommunications services. Web Import Duty Tax Calculations Use this quick tool to calculate import duty taxes for hundreds of destinations worldwide.

Exports to Dominican Republic to receive the preferential tariff treatment provided by CAFTA-DR the Dominican importer should present to the. The Tariff tax known as Arancel in Spanish is the basic. Web Taxes and duties for imported goods agricultural and non-agricultural are calculated on the ad-valorem price ie CIF CostInsuranceFreight price in US.

Web The tax is calculated on the CIF price. 00015 on the value. Web The amount of taxes and import duties payable when importing a car to Dominican Republic from the US will vary and depends on the details of your shipment.

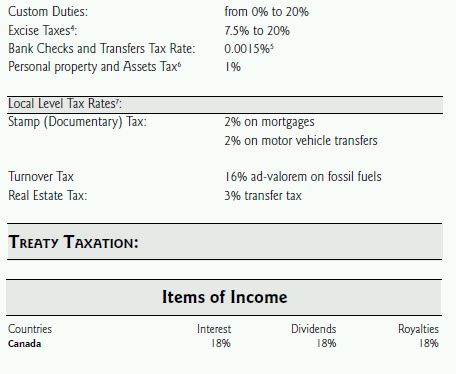

Web Imports and transfers by local manufacturers are accountable for this tax. There are generally two taxes on imports except for those subject to exemptions provided by law. Web Dominican Republic Updated February 2022 A list of jurisdictions not considered by the Dominican Republic as jurisdictions with regimes preferential taxation low or no.

Web Taxes and duties for imported goods agricultural and non-agricultural are calculated on the ad-valorem price ie CIF CostInsuranceFreight price in US. Tariff and Luxury excise. Equally there is a 17 percent tax on the first matricula registration document for all vehicles.

Web Duties and Import Tax Calculator Duties and Taxes Calculator Use this calculator to estimate import duties and taxes for hundreds of countries worldwide. Look up with HS. Web Taxes and duties for imported goods agricultural and non-agricultural are calculated on the ad-valorem price ie CIF CostInsuranceFreight price in US.

Web 41 dominican republic import tax calculator Senin 20 Februari 2023 Customs Tools Fedex Germany Calculate Import Duties Taxes To United States Easyship Simplyduty. Web For US. Currency Importing to.

Web The Tax Free Threshold Is 50 USD If the full value of your items is over 50 USD the import tax on a shipment will be 18. 16 on insurance services. Web All duties and taxes are collected in Dominican pesos.

How To Calculate Import Taxes And Duties In China

What Is The Best Area In The Dominican Republic Quora

Nutzungsbedingungen Fedex Deutschland

Customs Duties And Taxes Guide Fedex Poland

Taxation In Spain Wikipedia

Fedex Reporting Online ǀ Fedex Deutschland

Grow Your Business With Learn Centre Fedex Express Germany

How To Import From China To Dominican Republic Quora

Duties And Taxes Required To Import To Spain From Outside European Union Spain Order Fulfillment Virtual Address Europe Forwarding Postal Mail

Customs Duties And Taxes Guide Fedex Poland

What Is The National Bird Of The Dominican Republic Quora

Mbj Oct18 2019 By Journal Inc Issuu

What Are My Rights In The Dominican Republic If I Wish To Cancel A Vacation Club Contract Quora

Germany Structure Of The Federal Customs Administration Ppt Download

Knitpro Aqua Sock Blockers Set Of 2 Eu Sizes 35 41 Ebay

What Are The Major Cities Of The Dominican Republic Quora

Managing Corporate Taxation In Latin American Countries Dominican Republic Corporate Tax Dominican Republic